Market Trends

The time to imposition of this new regulation was shorter than some expected, as 2025 had been a potential option. As such, the cascading effects of the sulfur limit on the refining industry are expected to be pronounced leading up to 2020, and somewhat onward.

The announcement of the quick implementation, in general, favors more complex refineries such as those in the United States. Is there is an opportunity to capitalize on market conditions by selling low-sulfur blend stock to other regions, particularly Europe, Middle East and Asia-Pacific? These regions account for more than 70% of the world’s demand for bunker fuel and lack the refinery complexity found in the United States. Market consultants have adjusted their predictions for crude and product pricing accordingly with the 2020 date.

Three major trends in refineries can be derived from the data:

The value of middle distillate products relative to fuel oil will be greatly heightened

The value of middle distillate products relative to fuel oil will be greatly heightened

Complex refinery configurations will experience much greater profitability than less complex counterparts

Complex refinery configurations will experience much greater profitability than less complex counterparts

Heavy, sour feedstock will provide a margin benefit for complex facilities

Heavy, sour feedstock will provide a margin benefit for complex facilities

Challenges

Refineries need to understand the challenges and downsides of this regulation change to respond with a strategy that can capitalize on its upsides. Several challenges include the potential for mismatched strategies between refiners and ship owners. Additionally, there are historical challenges to contend with, and external factors that may lead to inaction.

Historical challenges:

- Environmental expenditures often hurt refiners’ economics

- Refiners are not incentivized to be the first to act due to uncertainties.

- There is a tendency to “wait and see” what the competition will be doing.

- Time cost of money will deter early action.

- Philosophy of minimizing “sunk cost” to stay in business is often adopted.

External factors that contribute to challenges:

- Uncertainties in prices, and supply and demand

- High CAPEX

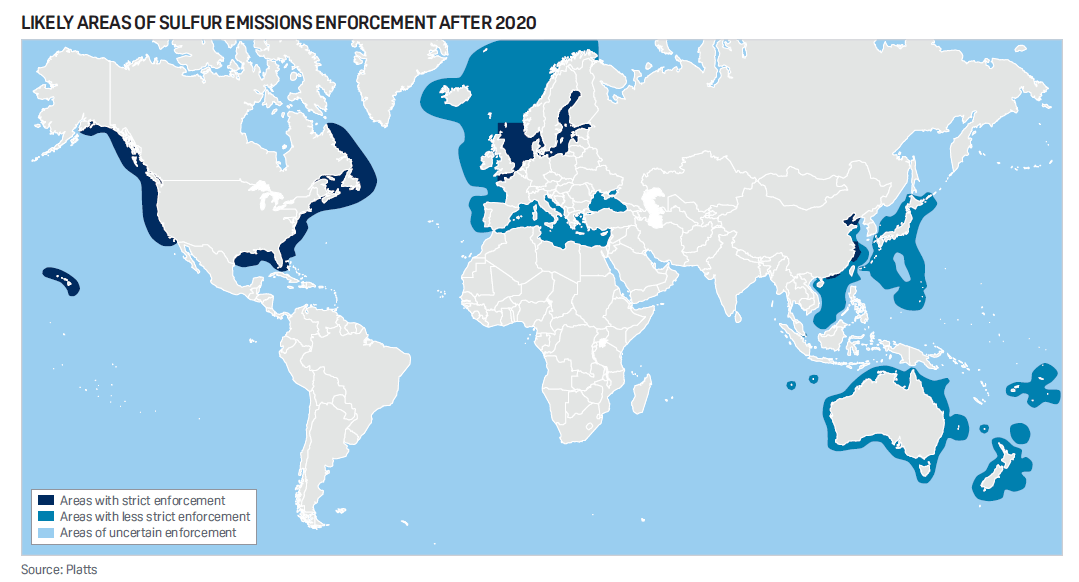

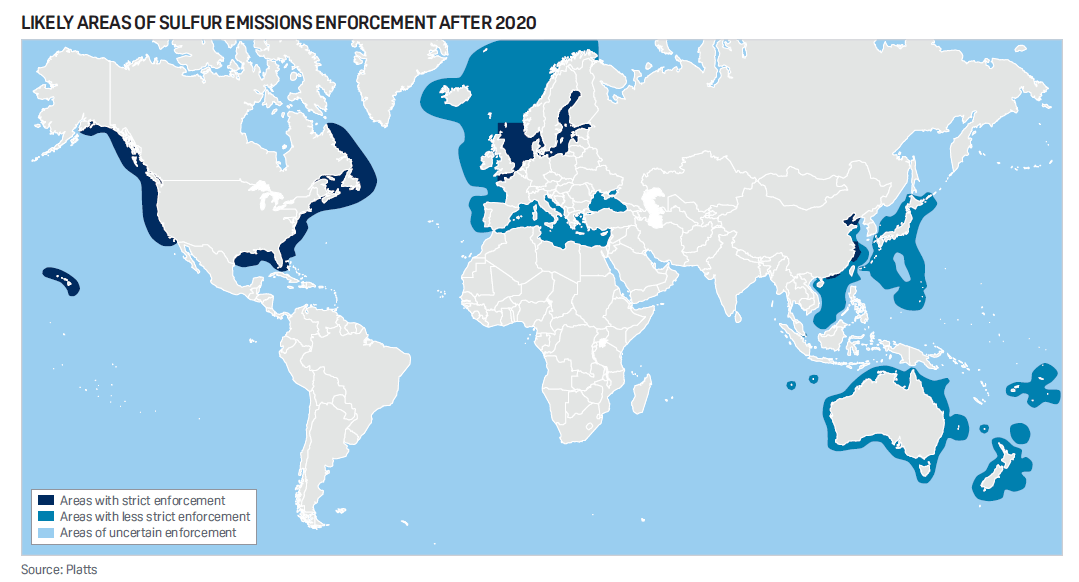

- Unpredictability in policy enforcement

- Crude oil strategies

- Overall timing

Solutions

Protecting refinery organizations from the downsides of this change and allowing them to further capitalize on the upsides will require changes in the day-to-day operations or processing steps at their facilities. Refineries may consider a means of achieving deeper conversion of residual content while also debottlenecking heavy oil processing units and sulfur trains to capture value provided by changing market conditions.

Refining organizations can achieve clarity in their strategic approach to the new IMO regulation by applying the four-step methodology, shown below:

- Market Assessment: Define various scenarios for market data development. Market data from a consultant or the client itself are required as inputs into forward-looking facility assessments.

- Configuration Analysis: Predict yields and economics for any update to existing facilities supported by extensive experience with refining technology and capital cost estimating with configuration modeling capabilities.

- Financial Analysis: Assess risks with easily comparable financial cases developed for different configurations and sensitivities on price points.

- Asset Upgrade Feasibility: Identify and engage unique opportunities and challenges involved with achieving expansion initiatives within a given refinery.

Opportunities

Where there is a challenge, there is always an opportunity. In anticipation of the enforcement of the IMO regulation, a clear strategic plan must be established to effectively take advantage of several emerging opportunities such as:

- Cleaner environment

- Combined defensive and offensive strategies

- Establishment of complex refineries

- Increased refinery competitiveness

- Integration of refinery and petrochemical business

- New product creation

- Value added beyond “staying in business"

We believe that with in-depth analysis and proactive preparation, refining organizations can emerge with increased value and opportunity in the face of these impending changes.

The value of middle distillate products relative to fuel oil will be greatly heightened

The value of middle distillate products relative to fuel oil will be greatly heightened